FlyFin Announces Business Hub for Self-Employed and Freelancers Seeking to Formalize Their Small Business

San Jose, CA, United States, 1st Nov 2022, King NewsWire, New Business Structure Advisor Tool Helps Self-Employed Determine The Right Business Structure and Demystifies Tax Consequences

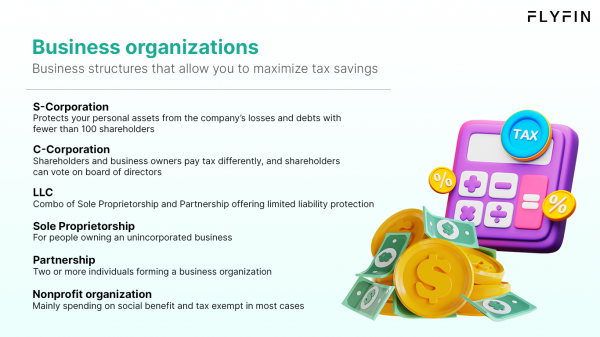

FlyFin, the world’s number one AI tax preparation and tax filing service, announced a new Business Hub for self-employed people and freelancers planning to take the next step in formalizing their small businesses. FlyFin’s new library provides freelancers and self-employed individuals with information about which organizational structure would be most beneficial for their business, clearly outlining the tax implications of each model. As part of the new information center, FlyFin also unveiled a new Business Structure Advisor tool to guide self-employed individuals in determining the ideal business structure for their particular small business.

Self-employed individuals and freelancers often need a more comprehensive understanding of the tax ramifications of the different business organization structures open to them. This information gap can often lead to confusion or mistakes when choosing the best option for their business. According to a survey by the National Association for the Self-Employed (NASE), less than half reported confidence in their understanding of the tax implications of their business structure – suggesting that there is a need for guidance.

FlyFin’s new information center provides detailed information about Sole Proprietorships (DBAs), S Corporations, C Corporations, Limited Liability Companies (LLCs), Partnerships and non-profit organizations (NPOs). It also highlights and demystifies tax forms and filing for these different business structures. Freelancers and self-employed individuals will also find all the steps required to incorporate and learn about each corporate structure’s advantages and disadvantages.

In 2018, the IRS issued more than $10 billion in penalties to small businesses. The most common errors were related to filing and paying taxes late, not paying enough taxes throughout the year, and not keeping accurate records. FlyFin’s AI-powered platform helps tax filers save the maximum on their taxes. CPAs are on standby 24/7, so taxpayers can ask a CPA for advice on how to pay the least amount of tax possible.

Trusted by 100k+ freelancers, FlyFin’s quarterly tax calculator is the only one that considers a person’s income and deductions, allowing business owners to assess how different combinations of income and tax write-offs can affect their overall taxes owed. Using FlyFin’s quarterly tax calculator regularly can help self-employed individuals and 1099 workers budget for their quarterly tax payments, avoid tax penalties or interest charges and better manage their taxes.

About FlyFin

FlyFin is an award-winning, AI-powered platform that provides self-employed, sub-contractors, independent contractors, gig workers, freelancers and creator economy workers with a convenient, easy-to-use and affordable tax filing solution. FlyFin helps individuals maximize self-employment tax deductions and income tax refunds. With a “Man + Machine” approach, FlyFin leverages AI paired with highly experienced tax CPAs to deliver automation that eliminates 95% of the work required for 1099 self-employed individuals to prepare their taxes. FlyFin is a privately-held, venture-backed company based in San Jose, California.

Media Contact

Organization: FlyFin

Contact Person: Carmen Hughes

Email: [email protected]

Phone: +1.650-576.6444

Website: https://flyfin.tax/

City: San Jose

State: CA

Country: United States

The post FlyFin Announces Business Hub for Self-Employed and Freelancers Seeking to Formalize Their Small Business appeared first on King Newswire.

Information contained on this page is provided by an independent third-party content provider. King Newswire and this Site make no warranties or representations in connection therewith.

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]